A rendering shows the exterior of Blue Whale Materials' facility that is now under construction in Bartlesville. Blue Whale Materials

One of 25 companies to receive the Battery Manufacturing and Recycling Grant, Blue Whale Materials expects to add 150 permanent and 180 temporary jobs as production increases in increments over the next four years.

As part of a billion dollar initiative, the grant is one of many examples of how federal funds are being used to reduce American companies’ dependence on critical mineral supply chain operations in countries like China and Russia. Lawmakers on both the federal and state levels passed new laws and proposals to increase the effort.

“They are very interested in building out the domestic supply chain for battery materials,” said Fauvre, Blue Whale Materials cofounder and chief strategy officer. “There’s been a lot of investment in building out cell production capabilities in the U.S. and you can see that with all the manufacturing facilities going up throughout the country.”

Critical minerals used to create materials for companies, like Blue Whale Materials, that produce electric vehicle batteries, include cobalt, nickel and lithium.

The U.S. Department of Energy projected to generate $16 billion in investment from domestic battery recycling and manufacturing through the program. Other departments, like the U.S. Department of Commerce also have awarded federal funding to the manufacturing industry.

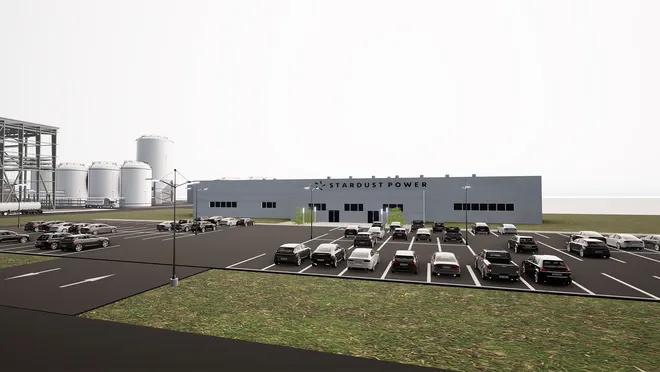

Stardust Power operates a battery-grade lithium manufacturing facility in Muskogee. Stardust Power

Manufacturing in Oklahoma

Domestic manufacturing supply chain operations will most likely experience production and labor growth as lawmakers put restrictions on foreign trade and foreign imports become more expensive.

Data from a report released Sept. 26 from the Federal Reserve Bank of Kansas City showed production and employment in the region will most likely increase substantially, despite hitting its lowest this month since 2020.

Lighter regulations make Oklahoma an attractive stop in the manufacturing supply chain. According to the Oklahoma Department of Commerce, over 4,200 manufacturers operate in the state, where electric rates are 20% to 30% lower than the national average.

Paramita Das, the newly appointed Stardust Power chief strategy officer, said there are many contributing factors that make Oklahoma appealing to both small and large manufacturing operations.

“Oklahoma does provide a central location to the country with close proximity to where customers are putting investments in in the surrounding state,” Das said. “It gets our material out to customers in a very cost-efficient, timely manner.”

“Shovel-ready” and linked to transportation, as Das put it, Stardust Power plans to expand its battery-grade lithium manufacturing operations in Muskogee by 2025.

Like Blue Whale Materials, Stardust Power founder and CEO Roshan Pujari’s personal ties to the state contributed to bringing the business here. Though, Das said that’s not the only reason the company decided to expand its facilities in the state.

“If you look at the history and everything that Oklahoma has to provide, there is talent out there, the workforce, the partnership model that the state provides and affords, and the fact that our customers really want a truly North American, American-born supply chain, which Oklahoma allows us to do.”

What lures manufacturers to Oklahoma differs among the companies that have been drawn here.

Canoo, an EV platform, searched nationwide for the right place to invest in manufacturing plants, selecting Oklahoma as a partner state. Chief Financial Officer Greg Ethridge said as a right-to-work state and a central hub in the United States, Oklahoma appealed to leadership.

“We thought it was a great place to get support from the state and the people to bring auto vehicle and manufacturing back to the state,” Ethridge said.

In August, Canoo announced relocating its main operations to the region, moving its headquarters to Texas from California and expanding engineering operations in Pryor and Oklahoma City.

As the company grows, it plans to bring over a thousand jobs to the state with an average wage of $60,000. Working closely with the Cherokee nation, it will bring jobs to tribes as well, Ethridge said.

Canoo hosted a Supplier Day Canoo Inc

Anticipating labor shortages

The U.S. Commerce Department will soon award a nearly $472,000 grant to the Oklahoma Manufacturing Alliance. This is the first year the grant funds will be used solely for recruitment and training efforts.

After a decade of using billions of dollars in federal funds to strengthen the manufacturing supply chain network nationwide, the alliance changed the purpose of the grant to avoid what they say will be a labor shortage of 20,000 workers in the state by 2028.

“We went for this because we have a global problem with population,” said Sharon Harrison, Oklahoma Manufacturing Alliance’s vice president of workforce development. “It’s not going to go away. We have a growing manufacturing sector in Oklahoma, which is exciting. It’s becoming more diversified. But with that, we don’t have and will not have enough of a workforce if we look at our current pipelines.”

Prioritizing key groups with high unemployment rates in Oklahoma, recruitment efforts will focus on Black populations, people with disabilities and veterans to fill gaps in the manufacturing workforce.

“We’ve been dipping our toes and are doing some work with these populations for a while,” Harrison said. “But if you look at Oklahoma, we really wanted to focus on those three populations because we thought they could bring the biggest impact to manufacturing but also communities in which they live.”

The grant will be awarded Oct. 1 and distributed until March 31, 2026.

Several partnerships and collaborations will work together to strengthen and expand manufacturing recruitment efforts with funds awarded by the grant, including the Oklahoma Manufacturing Alliance, Harrison Consulting Group and several manufacturers. Colleges, workforce development agencies and community organizations will also participate.

The Oklahoma Manufacturing Alliance’s new strategy will focus on growing manufacturing sectors like the automobile, drone and biomanufacturing subsectors. Through a “learn and earn model,” workers will be able to join a paid apprenticeship to enhance skills while earning a livable wage.

Meanwhile, several state agency officials at the Oklahoma Department of Commerce and Oklahoma Employment Security Commission deny a manufacturing skill gap, stating that more production could be achieved with fewer workers.

But Harrison, who meets with manufacturers every week, disagreed.

“It [is] the same problems: ‘We can’t find workers,'” Harrison said. “Whenever we do hire them, they don’t necessarily have the right skills, so we build them in.”

Das of Stardust Power said there is a balanced need for both tech and talent for its critical mineral production’s early stages. “From a demand and supply perspective, there is, just in the sense of capacity, a 30% gap in that we see in the current demand versus supply,” Das said. “Now it comes down to the technology.”

Labor shortages haven’t been a huge issue so far, said Ethridge of Canoo. However, he said he expects that to change as the company grows. “As we get more and more into the ramp, we may face more of those roadblocks, but we’ll work through them,” he said. “Some of that is addressed by time.”

Surveys conducted by the Federal Reserve and published in its latest report found 63% of manufacturers said they didn’t expect their technology investments to affect employment levels over the next year. Data also showed an increase in the number of job applicants per job opening since last year, up to 45%.

“It’s never going to be a fully automated location,” Ethridge said.

Stardust Power team attends a NASDAQ event at Times Square in New York City. Photo By Vanja Savic

Foreign relations and domestic supply chains

After a complex multi-step application process, Blue Whale Materials plans to expand its Bartlesville facility at a total cost of $110. Of the total, $3 million will go toward funding workforce development and community outreach. Fauvre said Gov. Stitt, who could not be directly reached for comment due to recovering from heart surgery, supported the expansion project.

A spokesperson for the governor said Stitt recognized the threat posed by China controlling up to 60 percent of the supply chain and has called for action on the need to prevent China from monopolizing the manufacturing supply chain. It’s an issue that is of big interest to him.

“The State of Oklahoma welcomes this additional investment to expand the Blue Whale Materials li-ion battery recycling plant in Bartlesville,” Stitt said in a news release. “This investment aligns with our state’s focus on self-sufficiency in critical materials production and will bring quality jobs and investment to Oklahoma.”

The Federal Bank found inequities in international supply chains in its latest report:

“We continue to believe that domestic industrial manufacturing is, and has been, in a recession for quite some time. It appears to be hitting harder than it has as shown by lower orders and fewer opportunities. Foreign dumping of product continues to be unfair and rampant.”

Founded in 2017, Canoo started when political tensions had begun to rise, allowing the company to avoid creating a supply chain too heavily invested in oversea operations.

“In Oklahoma and in the U.S., manufacturing is critically important as we go through these geopolitical tensions and terrorists and all the other types of craziness that’s happening right now,” Ethridge said.

Designated as a foreign trade zone by the U.S. Customs and Border Patrol, Canoo operates differently from many of its competitors. Immune to import tariffs, the company brings a small portion of manufacturing parts from other countries. Ethridge said some companies source up to 50% of supplies from Asia or China.

“So, obviously the extent or the amount of work to unwind them from that is quite substantial,” he said.

Canoo only sources around 10% of supplies from other countries.

As one of only hundreds of American manufacturing supply chains operating as a Foreign-Trade Zone, Canoo entered the $30 billion EV market in Saudi Arabia. Ethridge said the company wants to build a competitive product in both national and international markets. Though, most operations will stay domestic and most exported goods will be sent from Oklahoma to foreign markets.

Das said bipartisan regulations on both the state and federal level have helped domestic companies and brought confidence to the U.S. industrial space to make the right investments to nearshore supply chain operations in the United States and allied countries.

“At the end of the day, there is a critical reliance on critical minerals on let’s just say ‘not so friendly’ jurisdictions,” Das said.

Stardust Power Contacts

For Investors:

Johanna Gonzalez

Stardust Power Inc.

johanna@stardust-power.com

For Media:

Michael Thompson