Chinese companies have signed preferential deals with lithium-rich nations and benefited from huge government investment in the complex steps between mining and manufacturing. That has contributed to the U.S. and Europe allocating funds and setting up policies to create opportunities for extracting lithium from alternative sources to reduce dependence on China.

Chinese Dominance

China's Market Share

China’s market share for lithium-ion batteries could be as high as 80%, according to estimates from BloombergNEF.

Chinese Refining

In 2022, 56% of Global Refining Capacity was Concentrated in China.

US Production Shortfall

U.S. contributes less than 2% of world supply of lithium even though it holds 17% of global lithium reserves.

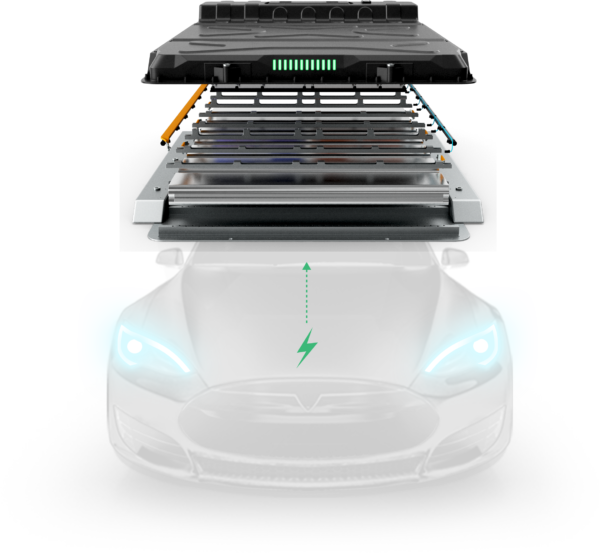

An electric car battery has between 30 and 60 kilograms of lithium

That’s more than the global supply in 2020. Some experts fear a repeat of the oil crisis sparked by Russia’s invasion of Ukraine, with geopolitical tension spilling over into a war of sanctions. Such a scenario could result in China shutting off its supply of batteries just as Western automakers need them to power the switch to EVs.

According to Andrew Barron...

That makes Western efforts to expand battery production capacity “more imperative than ever.” “Those efforts are taking shape, albeit slowly.” It is currently estimated that there will be 13 new gigafactories in the United States by 2025, joined by an additional 35 in Europe by 2035; however, many of these projects are beset by logistical problems, protests, and NIMBYism. These gigafactories are going to need a substantial quantity of lithium.